On August 4 2017 the Companies Commission of Malaysia CCM has brought into force audit exemption for certain categories of private companies. From 1st January 2016 until today Company A has not conducted any business activity.

Financial Accounting And Bookkeeping Concept Download Free Vectors Clipart Graphics Vector Art Learning Design Financial Accounting Concept

Its total assets in the current Statement.

. However client satisfaction did not. Company A may apply for audit exemption. How to Qualify for Audit Exemption in Malaysia.

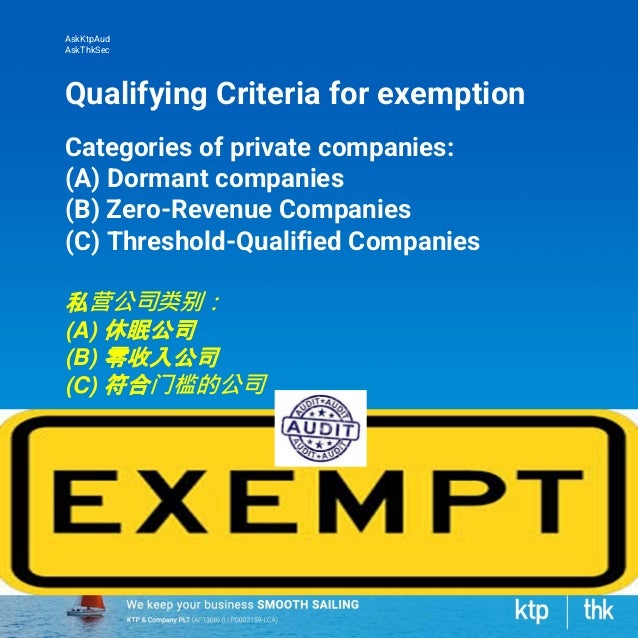

To further reduce the cost of doing business the Companies Commission of Malaysia has announced that dormant zero-revenue and threshold-qualified private companies are eligible to elect for audit exemption. Small and medium-sized enterprises SMEs are playing an increasingly important role in the process of industrialization in the developing world. A threshold-qualified company is a private entity as defined by the MASB and is qualified for an audit exemption if.

The following categories of private companies qualify for an audit exemption. Although in general all companies are required to prepare and audit the financial statements the Companies Act 2016 empowers the Registrar to exempt certain categories of private. Audit exempt for zero-revenue companies financial statements with annual periods commencing on or after 1 January 2018.

Company B was incorporated on 1st January 2016. Just be mindful that if you are in year 2020 you will normally be preparing the audited report for financial year 2019. To support SMEs many developed countries such as Australia New Zealand and the United Kingdom have implemented an audit exemption regime for SMEs while in Malaysia the policy makers and regulators have.

The Company Commission of Malaysia SSM later in 2017 issued a Practice Directive containing criteria for private companies to not have to appoint an auditor in a financial year ie. A it has revenue not exceeding RM100000 during the current financial year and in the immediate past two 2 financial years. The criteria for audit exemption for certain private companies are.

How to Qualify for Audit Exemption in Malaysia. In August 2017 Suruhanjaya Syarikat Malaysia SSM issued Practice Directive 32017 Qualifying Criteria for Audit Exemption for Certain Categories of Private Companies and invoked subsection 267 2 of the Companies Act CA 2016 to exempt certain private companies from having to appoint an auditor according. The results found that audit benefits and audit challenges have a significant effect on the level of acceptance on audit exemption among SMEs in Malaysia.

Revenue here includes revenue receivable during the year. The issue of audit exemption among small companies has been addressed in studies in the UK Australia and Singapore together with several others while Malaysia still legally obligates all. It has revenue not exceeding RM100000 during the current financial year and in the immediate past two 2 financial years.

The Companies Commission of Malaysia has issued Practice Directive No. All companies incorporated in Malaysia must have their accounts audited by a Ministry of Finance approved auditor as mandated by the Companies Act of 2016. Definition of threshold-qualified companies.

32017 to set out the qualifying criteria for private companies to be exempted from appointing an auditor for a financial year. This article is based on Proposed Practice Directive 12017 on Audit Exemption issued by CCMSSM on 8 November 2016. Written by Gunalan Appalasamy CA M It was proposed that Dormant Companies.

On 4 August 2017 the Companies Commission of Malaysia or SSM its Malay acronym has brought into force audit exemption for certain categories of private companies. Company A was incorporated on 1st January 2016. A private company which falls within the following categories may opt for Audit Exemption.

A private company which falls within the following categories may opt for Audit Exemption. Just be mindful that if you are in year 2020 you will normally be preparing the audited report for financial year 2019. The Companies Commission of Malaysia SSM today issues a Practice Directive highlighting the categories of private companies that qualify for audit exemption.

The company is dormant this means the business has no accounting transactions occurring and its operations have. Dormant companies A dormant company is a private entity as defined by the Malaysian Accounting Standards Board MASB and the company is. 32017 to set out the qualifying criteria for private companies to be exempted from appointing an auditor for a financial year.

Assuming that the financial year-end is on 31 December every year. SSM has issued Practice Directive No. Efforts on Audit Exemptions.

Key Audit Matters In Enhanced Auditor S Report Tracing Malaysia In Its First Year Implementation Semantic Scholar

Pdf Audit Exemption For Small And Medium Enterprise Perceptions Of Malaysian Auditors

Pdf The Provision Of Non Audit Services Audit Fees And Auditor Independence

Key Audit Matters In Enhanced Auditor S Report Tracing Malaysia In Its First Year Implementation Semantic Scholar

Pdf Reasons Against Audit Exemption Among Sme Companies In Malaysia Semantic Scholar

St Partners Plt Chartered Accountants Malaysia 2 Zero Revenue Companies A Zero Revenue Company Is Qualified For Audit Exemption If It Does Not Have Any Revenue During The Current Financial Year It

Pin By Islamic Relief Malaysia Irm On Covid 19 Emergency Appeal Emergency Map Covid 19

1 Nov 2018 Budgeting Inheritance Tax Finance

Audit Exemption For Companies In Singapore Nexia

Key Audit Matters In Enhanced Auditor S Report Tracing Malaysia In Its First Year Implementation Semantic Scholar

Ccm Issues Practice Directive On Audit Exemptions For Private Companies Zico

Component Materiality For Group Audits

Pdf Reasons Against Audit Exemption Among Sme Companies In Malaysia Semantic Scholar

Pdf Reasons Against Audit Exemption Among Sme Companies In Malaysia Semantic Scholar

Ccm Issues Practice Directive On Audit Exemptions For Private Companies Zico

Gold Pound Symbol British Pound Symbol Isolated On White Paid Affiliate Sponsored Symb Como Economizar Dinheiro Simbolo De Libra Graficos Financeiros

The Sec S Audacious Audit Proposal How It Could Upend Industry Practices Private Funds Cfo

Group Audit Issues P7 Advanced Audit And Assurance Acca Qualification Students Acca Global